5 Simple Techniques For Quick Payday Loans Of 2022

Wiki Article

How Payday Loan can Save You Time, Stress, and Money.

Table of ContentsThe Definitive Guide to Quick Payday Loans Of 2022How Loans can Save You Time, Stress, and Money.Our Payday Loan DiariesThe Buzz on Loans

Your employer may deny your demand, yet it's worth a shot if it implies you can stay clear of paying excessively high charges and also interest to a cash advance lending institution. Asking an enjoyed one for aid may be a hard discussion, yet it's well worth it if you're able to stay clear of the extravagant interest that features a cash advance. Quick Payday Loan.Ask your loan provider a whole lot of concerns and also be clear on the terms. Plan a repayment strategy so you can pay off the financing in a timely manner and avoid ending up being bewildered by the included expense. If you understand what you're getting involved in as well as what you require to do to obtain out of it, you'll repay your finance faster and also decrease the impact of shocking rates of interest and charges.

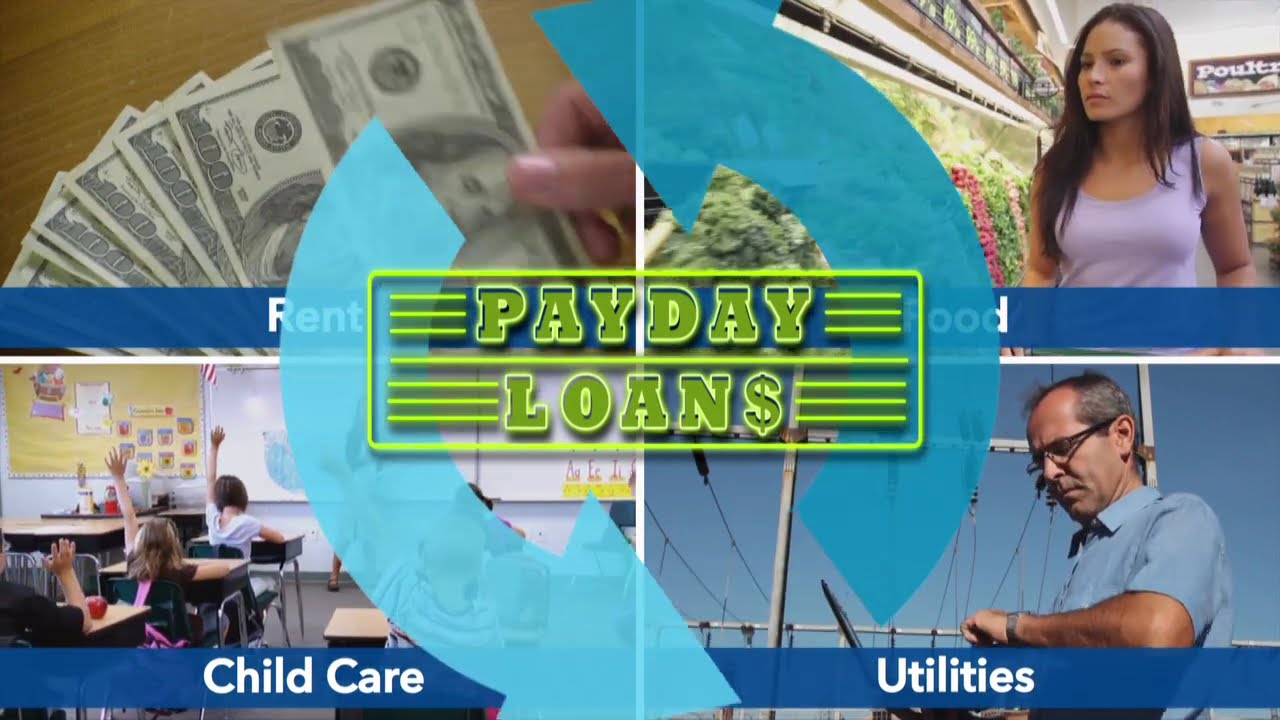

What ever the reason you require the financing, before you do anything, you ought to recognize the benefits and drawbacks of payday advance loan. Cash advance lendings are small cash money fundings that are supplied by short term loan lenders. Like any financial option, there are pros and cons of payday advance loan. They are promoted as quick cash advance that fast and hassle-free in these situations - Quick Payday Loan.

Below are the benefits that clients are looking for when looking for cash advance financings. With these cash advance, obtaining cash swiftly is a feature that cash advance have over its traditional competitors, that call for an application and afterwards later on a check to submit to your savings account. Both the authorization process and the cash money may supply in less than 1 day for some applicants.

Everything about Quick Payday Loan

Pay stubs and also evidence of employment are more important to the approval of your application than your credit report. Nearly any individual with a stable job can use for a cash advance, after merely responding to a handful of inquiries. These finance applications are likewise far more general than traditional alternatives, leaving space for the consumer to be as private as they require to be regarding their finance.

A quick online loan provider search will certainly prompt you to a range of alternatives for little cash money loans and fast cash advance. While there are numerous benefits and drawbacks of payday advance, on-line loan provider gain access to makes this alternative an actual comfort for those who need money quick. Some clients appreciate the personal privacy of the net lending institutions that just ask very little concerns, examine your earnings, and also down payment cash right into your account soon after you have digitally authorized your agreement.

What Does Quick Payday Loan Mean?

Like all excellent money options, there are concerning features that balance out those eye-catching benefits. As obtainable as something like a payday advance loan is, it can be something that is as well great to be real. Due to the clients that these short term loan lenders bring in, the drawbacks can be additional damaging to these clients and their financial states (Loans).Some clients discover themselves with rate of interest rate at half of the finance, or perhaps one hundred percent. By the time the funding is paid back, the quantity borrowed and also the rate of interest is a total of two times the original loan or even more. Since these prices are so elevated, consumers discover themselves unable to make the complete payment when the following check comes, furthering their financial debt and burdening themselves financially.

Some of these brief term lending lenders will certainly include a fee for customers who try to pay their loan off early to remove some of the rate of interest. When the payday advance loan is contracted, they anticipate the payment based upon when someone is paid and not earlier in order to collect the interest that will certainly be built Quick Payday Loans of 2022 up.

If the payday advance loan is not able to be paid in full with the following check, and the balance has to surrender, the client can expect yet another cost that resembles a late charge, charging them even more rate of interest essentially on the payday advance loan. This can be troublesome for a family members and also prevent them from having the ability to prosper with a lending - Quick Payday Loans of 2022.

An Unbiased View of Payday Loans

Many customers find these repayment terms to be devastating to their finances as well as can be even more of a burden than the need that caused the first application for the car loan. Sometimes clients discover themselves not able to make their payday advance payments and also pay their costs. They sacrifice their payment to the payday advance business with the hopes of making the settlement later on.

Once a debt collection agency obtains your debt, you can expect they will certainly contact you commonly for repayment via phone and also mail. Ought to the debt proceed to linger, these collection firms might be able to garnish your incomes from your paychecks up until your debt is accumulated. You can figure out from the individuals specify laws - Quick Payday Loan.

Report this wiki page